Before taking up this article, I wanted to introduce the topic of percentage arbitration. But having immersed myself in various formulas, dispersion and square deviation, I realized that now it is not as important as the topic is more vital and even to some extent close to everyone.

Earlier I wrote about the crisis of 2008, today we are talking about the Great Depression of the 30s. I’m sure you’ll find many similarities in this material…

with the current situation and get acquainted with some of the possible new concepts for you.

The Great Depression of the 30s was the biggest economic disaster in modern history. It was indeed a catastrophe that dramatically affected the lives of an entire generation. In just one year, between 1929 and 1930, industrial production not only in the U.S. but around the world fell by almost half. In Germany, it fell by 40%, in France by 30%. And only in England production was reduced by only 10%, although there was a crisis back in the early 20’s.

Industrialized countries then for the first time and fully faced a unique phenomenon – deflation, when prices for almost everything fell from 25% to 40% in different countries. There was a sharp decline in demand. Nobody was buying anything. The reason for this is the colossal unemployment. In 1933, the number of unemployed

in America was 25% of the total workforce. That is, one in four.

The beginning of the disaster

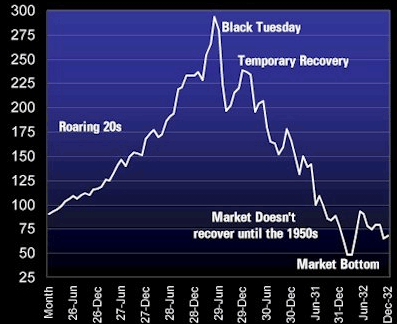

Depression began with the collapse of the New York Stock Exchange on October 24, 1929, the same “black Thursday,” which lasted until at least a black Tuesday, October 29. The loss of 880 issuers whose shares were listed on the New York Stock Exchange amounted to almost $9 billion. At that time it was twice as much as the amount of money in circulation. The total value of shares listed on the stock exchange back in September 1 was almost $90 billion, but by July 1932 this figure had already been $16 billion. In total, the stockholders lost $74 billion –

is the amount that three times exceeded the country’s spending on World War I. America’s national income was $87.8 billion, down to $40.2 billion in 1929. More than 135 thousand trade, industrial and financial companies collapsed.

Bank collapse

The banking crisis was also catastrophic. From 1921 to 1929, an average of 627 banks broke down annually, with deposits of about $ 169 million. During the first three years of the depression, 4,835 banks went bankrupt, with a total of more than $3.5 million in deposits.

In 1932, 40 banks went bankrupt daily. Think about it, every day two million dollars placed on bank deposits turned into dust. By the end of the year, the banking system had collapsed. In 1933, all banks in Detroit closed on February 14, and three weeks later banking “holidays” were announced throughout the country. People who overnight became homeless and unemployed dreamed of going to prison at least for a day for vagrancy to get shelter and bread.

An interesting fact: for six thousand jobs on construction sites in the USSR claimed 100 thousand Americans.

Becoming a global phenomenon, the Great Depression created economic chaos in Latin America, Africa and Asia, where prices for exported goods bonally collapsed due to lack of demand. Political systems had changed in many countries, dictatorships had been established. Hitler’s coming to power

in Germany was a direct consequence of the worst crisis.

In an attempt to somehow remedy the situation, leading industrial countries imposed trade restrictions on imports from other countries to support domestic producers. Naturally, this led to further increases in unemployment in other countries. International trade has found itself in a critical recession.

Reasons for the crisis

There is much debate about the causes of the economic disaster. Some call it a protectionist policy as the reason, someone believes that it was the consequences of the First World War, and someone points to the monetary order that existed at the time. The so-called “gold standard”, which prevented independent monetary policy and economic growth policy. And, by the way, countries that refused to tie their currency to gold were the first to overcome the depression less painfully. It was, however, the usual cyclical downturn characteristic of market economies, usually associated with overproduction, that could have turned into a catastrophe through the coincidence and action of not one but several economic shocks at once.

According to the English economist John Keynes, the main factor,

that triggered the Great Depression was investor uncertainty.

in the financial future.

The Struggle for Survival: Keynesian Theory

The first recipe for overcoming depression was Keynesian theory that the state can prevent economic downturns by actively using fiscal policy. In other words, less market – more government involvement through increased government stimulus spending. It is clear that increasing government spending, for example on road construction, became someone’s income, which eventually stimulated demand and should have caused economic growth.

The Franklin Roosevelt team that came in March 1933, guided by Keynes’ ideas, passed two tough and non-market laws to restore industry and agriculture, where more than 1 million farms went bankrupt because of the fall in demand in the United States.

In the industrial sphere, the measures were to support the largest monopolies. And in agriculture, subsidies for shrinking areas under crops.

and the livestock.

Roosevelt deliberately banned the export of gold, which significantly depreciated the dollar. The fall of the dollar was only halted at the end of January 1934, thanks to increased purchases of gold. In February 1934, the dollar was stabilised at 59% of the previous rate. Thus, the Roosevelt team devalued the dollar to win the trade war. Not right away, of course, but life really got better. The economy of most countries has experienced a period of stable high growth, at least remember the scientific and technological revolution and the invention of computers up to the 70’s.

Later, however, many countries faced another disease in the form of stagflation – a combination of inflation and economic stagnation. That is, zero or negative rates of economic growth. In the end, the blame for stagnation began to be laid on active government intervention policy.

And so, American economist and Nobel Prize winner Milton Friedman proposed an alternative doctrine called “monetarism”.

The idea of monetarism or a powerless economy…

The main idea of monetary policy was that the market economy should be self-regulating and strive for full employment without any government intervention. And economic fluctuations were largely the result of shifts in the volume of money supply. To some extent, we can now see the impact of these ideas if we look back at different periods of economic policy. But if during the depression no one has ever thought of throwing money away from a helicopter, because the dollar was provided with gold, since the crisis in 2008, regulators have taken a completely unknown path with the most unpredictable consequences.

Impact on modern markets

No one is saying that the world will face the same crisis right now. But the current level of euphoria in the markets is reminiscent of exactly what happened before the stock market crash in 1929. The current president, Donald Trump, is actively reviving trade war politics and the Fed is reducing liquidity and raising rates.

According to the rating agency S&P Global Ratings, the debt of American companies has increased to a record level and reached $6.3 trillion after a decade of extremely low interest rates. And this is only corporate debt, not including the banking sector.

U.S. corporations used the debt funds raised to conclude large-scale M&A deals, as well as to buy back their own shares. It is clear that now they will inevitably face problems with debt refinancing, because now the funds will have to be taken at higher interest rates. And emerging market companies will face not only an increase in the cost of borrowing, but also an increase in dollars, apparently due to the disparity of interest rates. Well, I didn’t avoid mentioning interest arbitration.

Let me remind you about the indexes as well. During the Great Depression in 1929, when the market collapsed, the Dow Jones index fell 9.2% over the week, about the same amount in 1933. In 2008, the index showed the worst week in its 112-year history, collapsing by 18.2% over the week.